wstanley.ru

Tools

Keep Track Of My Spending

The simplest way to track your finances is to record each transaction in a notebook. Choose to use the notebook for spending only, or opt for a more detailed. Quicken makes it easy to keep track of spending and quickly see charges by category. If a monthly expense is off or if there's a suspicious charge, you'll. Review your transactions, track your spending by category and receive monthly insights that help you better understand your money habits. Track your spending, subscriptions and other expenses in once place. Once you know where your money is going, you'll know what to cut back on. Tracking your expenses is an essential step toward achieving financial stability and success. By identifying unnecessary expenses, promoting better financial. Easily keep track of your business expenses so you can save time, not receipts. A smartphone shows a QuickBooks Online dashboard categorizing legal and office. Wallet is the all-in-one personal finance manager built to help you save money and plan for the future. Connect your bank accounts to track expenses. Use this method to keep track of income and bills. Each time you receive a bill, or paycheck, mark the date and amount on your calendar. This will help you. Keeping track of what you earn and everything you spend money on for a month, rather than just a week or two, lets you see all of your income and expenses. The simplest way to track your finances is to record each transaction in a notebook. Choose to use the notebook for spending only, or opt for a more detailed. Quicken makes it easy to keep track of spending and quickly see charges by category. If a monthly expense is off or if there's a suspicious charge, you'll. Review your transactions, track your spending by category and receive monthly insights that help you better understand your money habits. Track your spending, subscriptions and other expenses in once place. Once you know where your money is going, you'll know what to cut back on. Tracking your expenses is an essential step toward achieving financial stability and success. By identifying unnecessary expenses, promoting better financial. Easily keep track of your business expenses so you can save time, not receipts. A smartphone shows a QuickBooks Online dashboard categorizing legal and office. Wallet is the all-in-one personal finance manager built to help you save money and plan for the future. Connect your bank accounts to track expenses. Use this method to keep track of income and bills. Each time you receive a bill, or paycheck, mark the date and amount on your calendar. This will help you. Keeping track of what you earn and everything you spend money on for a month, rather than just a week or two, lets you see all of your income and expenses.

Like others, I also use an Excel spreadsheet. I have a summary tab which acts as a dashboard, showing my budget broken down by major. Track all your money by creating a budget It's important that you keep an accurate track of your income and costs. · Review your costs. Reviewing them allows you. Expense Tracker: Keep Track Daily Expense Tracker Organizer Log Book | Expenses Ledger Journal Logbook | Budget Planner |Spending Bill Payment Record. A monthly budget is a useful tool you can use to track both income and expenses. The information enables you to adjust your spending habits and make better. What Are 5 Good Ways to Keep Track of Your Expenses? · 1. Manual method · 2. Calendar plan · 3. Spreadsheet system · 4. Template technique · 5. App approach. It should help you allocate the money you have flowing into your account each month into the spending categories that matter most to you now and in the future. With someone like you in mind, who thinks of a budget as a way to keep track of what you spend, we created our Income and Expense Running Total tool. It's a. Money Monitor, part of Associated Bank Digital, delivers tools and insights to help you easily track your spending, grow your savings and reach your financial. If you want to take charge of your finances, keeping track of your spending is a good place to start. The information you collect can help you identify. Expenses has been crafted to keep track of your spending effortlessly, with useful features in a simple, intuitive interface. One week for daily spending. Start small by recording your spending every day for at least a week. · Fortnightly or monthly for recurring expenses. If you have. Expense trackers not only help you keep your spending in check now but also provide an auditable record of your past spending data. That gives you a lot of. “One of the easiest ways to keep track of your spending is your mobile banking app,” says Sonali Divilek, head of digital products and channels at Chase. Spending Tracker: A Log Book To Keep Track Of Your Daily Expense For A Month - Simple Money Management Diary: Penguin, Fuzzy: wstanley.ru: Books. Popular Mint features have made the leap to Credit Karma to help you grow your money. · Keep tabs on your money in one place. · Track your monthly spending and. Automatically categorizes spending and sends alerts if you exceed budget in any area. Excel spreadsheet - Old school but you keep a simple. Keeping track helps you stay on top of fraud as soon as it occurs and helps with sticking to a budget and maintaining a low balance. bubble-expenses. Whether. Keeping a daily record of your expenses by tracking receipts, invoices, and other outgoing expenses improves the financial health of your budget. Tracking. If you want to get a handle on your spending but don't want an app to access your financial accounts, the no-frills Spending Tracker provides an excellent first.

Which Online Shopping Platform Is Best

Ease of use: Wix is known for its intuitive drag-and-drop website builder, making it easy for beginners to design and set up an online store without any coding. China is the biggest and top eCommerce market in the world, with annual online sales of $ billion. Over the last decade, China's retail sales have expanded. Square Online accepts and manages orders, both online and in-store from social and mobile showroom to stockroom, for today and tomorrow. Integration with physical retail: When shopping online, customers want to know whether they can find a given product at a nearby retail store. A good. platforms, and shipping carriers, are integral for an online store. Explore the integrations that eCommerce software vendors offer and whether they support. Online shoppers engage in online shopping cart abandonment 68 percent of the time. Ecommerce Platforms, “In-Depth PayPal Reviews: Is PayPal the Right Payment. What is an ecommerce platform? · 7 features to look for in ecommerce platforms · 6 best ecommerce platforms for businesses. Shopify; WooCommerce; Square Online. Shopify was started in It is one of the most established eCommerce platforms in the world right now. The best thing about Shopify is that everything that. WooCommerce is the best free eCommerce platform built on WordPress. One of the best things about WooCommerce is that it's an open-source eCommerce platform. Ease of use: Wix is known for its intuitive drag-and-drop website builder, making it easy for beginners to design and set up an online store without any coding. China is the biggest and top eCommerce market in the world, with annual online sales of $ billion. Over the last decade, China's retail sales have expanded. Square Online accepts and manages orders, both online and in-store from social and mobile showroom to stockroom, for today and tomorrow. Integration with physical retail: When shopping online, customers want to know whether they can find a given product at a nearby retail store. A good. platforms, and shipping carriers, are integral for an online store. Explore the integrations that eCommerce software vendors offer and whether they support. Online shoppers engage in online shopping cart abandonment 68 percent of the time. Ecommerce Platforms, “In-Depth PayPal Reviews: Is PayPal the Right Payment. What is an ecommerce platform? · 7 features to look for in ecommerce platforms · 6 best ecommerce platforms for businesses. Shopify; WooCommerce; Square Online. Shopify was started in It is one of the most established eCommerce platforms in the world right now. The best thing about Shopify is that everything that. WooCommerce is the best free eCommerce platform built on WordPress. One of the best things about WooCommerce is that it's an open-source eCommerce platform.

one platform from Square Online With a Square Online free plan, you can immediately start using our website builder to get your online store built right away. The variety of website categories has broadened, and e-commerce rankings indicate an upswing in online selling sites like Facebook Marketplace. Clarity eCommerce Framework is an enterprise-class eCommerce platform solution that helps your online store The best eCommerce solutions for online shopping. News and analysis on technology in retail stores and online, including Global e-commerce platform Shopware personalizes search with AI. Shopware is. wstanley.ru is ranked number 1 as the most popular website in the Ecommerce & Shopping category in August The average amount of time that users spend on. Taobao (淘宝) Taobao is the largest C2C platform in China, having been founded in and solidifying its position as the nation's biggest marketplace in. don't take our word for it, our store owners love us We're the highest rated free eCommerce platform in the world! great examples of successful online stores such as Shopify or even Amazon. The best platforms are cloud-based and offer built-in customer personalization. Shopify stands out as a top choice for eCommerce businesses due to a combination of compelling features. The simplicity and speed of setting up an online store. The top three—wstanley.ru, wstanley.ru, and wstanley.ru—continue to dominate, accounting for over 40% of total e-commerce sales, similar to previous years. The fourth. For financials, Wix is best for businesses that prefer Wix Payments, Square or Stripe over third-party processors. Its payment integrations are more limited. Find out which are the best ecommerce platforms for running your online store. Complete comparison of hosted ecommerce solutions. About BigCommerce BigCommerce (Nasdaq: BIGC) is a leading open software-as-a-service (SaaS) ecommerce platform that empowers merchants of all sizes to build. A website template for an online clothing store on the Wix platform. Visit What is the best eCommerce website builder? Show more. There are several. I've reviewed and recommended some of the best eCommerce platforms to choose the best platform for online stores. The largest of these online retailing corporations are Alibaba, wstanley.ru, and eBay. Ecommerce platform & online marketplace comparison. Find the best Printful integration for your store. Take a quiz. Flipkart operates one of the largest e-commerce platforms in India, vying only with Amazon for the top spot. It sells everything from clothing to furniture to. Shopify offers beneficial features to aid businesses form and run online stores. It also incorporates tools for offline trading. Approximately around New technology continues to make it easier for people to do their online shopping. This method of e-commerce is best suited for companies that may.

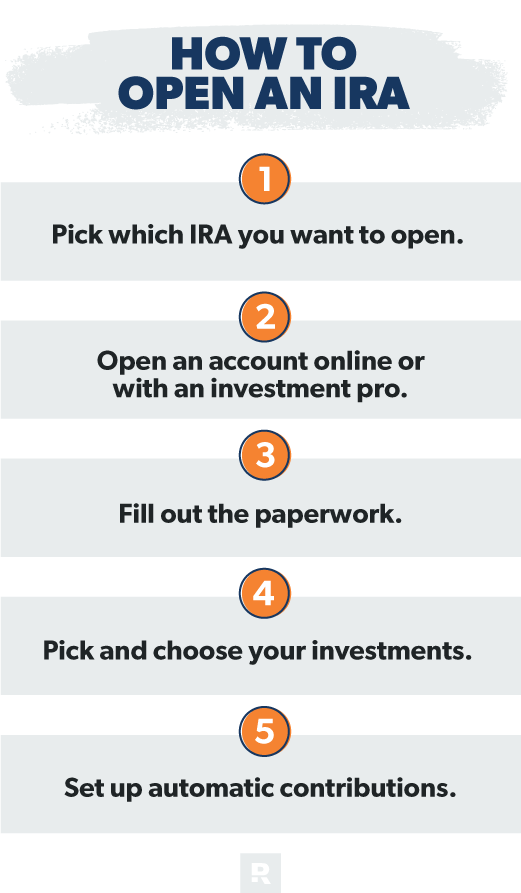

Opening An Ira Account

There's no charge to open a Vanguard IRA. The fund or product you choose may have a minimum investment amount. Minimum investments for Vanguard mutual funds can. Start planning for your future when you open an IRA. Learn how opening an IRA account can help you save for retirement with potential tax advantages. Regardless of your account balance or how often you trade, you can open an account with a $0 minimum deposit plus get $0 online listed equity trade commissions. IRA Savings Accounts: Flexibility With Your Retirement Savings Earn dividends on your money and save on your terms with an IRA savings account from Navy. Can open and make a contribution to your Traditional IRA for a tax year at any time during the tax year or by your individual federal tax return filing deadline. You can open an IRA through a bank, an investment company, an online brokerage, or a personal broker. Key Takeaways. Individual retirement accounts (IRAs) are. Individual retirement accounts can offer significant tax advantages as you save for your retirement. Explore IRA solutions and open an account online today. A savings IRA account can help you make the most of your hard-earned retirement. Explore IRA options from Bank of America and open an account online today. Anyone with earned income who meets the eligibility requirements can open an individual retirement account (IRA). Money within the IRA account grows tax-free. There's no charge to open a Vanguard IRA. The fund or product you choose may have a minimum investment amount. Minimum investments for Vanguard mutual funds can. Start planning for your future when you open an IRA. Learn how opening an IRA account can help you save for retirement with potential tax advantages. Regardless of your account balance or how often you trade, you can open an account with a $0 minimum deposit plus get $0 online listed equity trade commissions. IRA Savings Accounts: Flexibility With Your Retirement Savings Earn dividends on your money and save on your terms with an IRA savings account from Navy. Can open and make a contribution to your Traditional IRA for a tax year at any time during the tax year or by your individual federal tax return filing deadline. You can open an IRA through a bank, an investment company, an online brokerage, or a personal broker. Key Takeaways. Individual retirement accounts (IRAs) are. Individual retirement accounts can offer significant tax advantages as you save for your retirement. Explore IRA solutions and open an account online today. A savings IRA account can help you make the most of your hard-earned retirement. Explore IRA options from Bank of America and open an account online today. Anyone with earned income who meets the eligibility requirements can open an individual retirement account (IRA). Money within the IRA account grows tax-free.

There is no account fee to own a TIAA IRA; however, brokerage transaction fees may apply. In addition, investors are subject to the underlying funds' portfolio. roth, traditional and education iras. Money Market · FDIC insured · Tax-advantaged · Additional deposits of $25 or more can be made at anytime · Get started. Open a Traditional or Roth IRA account. With a Citibank IRA, you can choose to deposit your funds in a money market account or CD. Learn how to open an IRA. Roth IRA · Pay taxes now. · Receive tax-free withdrawals from qualified distributions. · May be a good option if you're in a lower tax bracket. · Minimum investment. No account fees or minimums to open Fidelity retail IRA accounts. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs), and. For IRA accounts: While opening an Ally Invest IRA account online, you'll be asked to identify at least one primary beneficiary for your account. To update. There's no minimum age for opening an IRA. Students can open one for themselves, and parents can open an account on behalf of their young children. Getting such. You can open an IRA at financial institutions, such as banks, brokerage firms and even mutual fund companies. While some IRAs have no minimum deposits, others. Open a Roth IRA with Merrill and give your contributions the opportunity to grow tax free through retirement. Learn how to get started investing today. An individual retirement account (IRA) is a tax-advantaged investment account designed to help you save toward retirement. IRAs are one of the most effective. Which Wells Fargo IRA is right for you? For more information, contact a Wells Fargo Retirement Professional at Select your own investments · No account-opening fees or minimums4—invest with as little as $1 · Choose from a broad range of investment options, including those. Your Merrill Edge Self-Directed traditional IRA has unlimited $0 online stock, ETF and option trades with no trade or balance wstanley.rute 4 Options. How do I open an IRA account? The easiest way to open a Schwab IRA account is online. You can also get help opening an account by calling us at Traditional IRAs provide tax-deferred growth. Any income your IRA investments earn will not be taxed until you start taking distributions from the account. This. The first step in opening an IRA is to select the option that fits your individual investment style. It's important to know that application instructions vary. IRAs are similar to employer-sponsored (k)s, but you open, fund and manage IRAs on your own. Some people use them to supplement their employer-sponsored. Traditional IRA accounts are a special type of investment vehicle that allow your earnings to grow tax-deferred. In your Traditional IRA account, you can invest. Step 1: Determine which type of IRA you'd like. · Step 2: Choose an IRA provider. · Step 3: Open and fund your IRA. · Step 4: Pick your investments. IRA Savings Bank Accounts from Discover offer both Traditional and Roth IRAs with high interest rates. View our IRA Savings rates and open an account today.

How Much Will Roth Ira Grow

You could see 25% growth in some years, and 15% losses in other years. Still, 8% is the long-term ROI in the stock market, so it's a reasonable average to. The Roth IRA can provide truly tax-free growth. JavaScript is required The amount you will contribute to your Roth IRA each year. This calculator. Advisor Insight Roth IRAs are especially appealing to younger investors because the growth can be as high as four to eight times what they originally invested. A Roth individual retirement account (IRA) is a retirement account that gives you a chance to grow your money over time by investing already-taxed dollars in a. Tax Deferred Investment Growth Calculator: How will my future value and investment return differ between taxable and tax deferred investing? Interest Calculator. Contributing to a traditional IRA can create a current tax deduction, plus it provides for tax-deferred growth. While long-term savings in a Roth IRA may. Free Roth IRA calculator to estimate growth, tax savings, total return, and balance at retirement with the option to contribute regularly. While there are no current-year tax benefits, your contributions and earnings can grow tax-free, and you can withdraw them tax-free and penalty free after age. Use this calculator to compute the amount you can save in a Roth IRA where you pay taxes on your income now, but withdraw the funds tax-free in retirement. You could see 25% growth in some years, and 15% losses in other years. Still, 8% is the long-term ROI in the stock market, so it's a reasonable average to. The Roth IRA can provide truly tax-free growth. JavaScript is required The amount you will contribute to your Roth IRA each year. This calculator. Advisor Insight Roth IRAs are especially appealing to younger investors because the growth can be as high as four to eight times what they originally invested. A Roth individual retirement account (IRA) is a retirement account that gives you a chance to grow your money over time by investing already-taxed dollars in a. Tax Deferred Investment Growth Calculator: How will my future value and investment return differ between taxable and tax deferred investing? Interest Calculator. Contributing to a traditional IRA can create a current tax deduction, plus it provides for tax-deferred growth. While long-term savings in a Roth IRA may. Free Roth IRA calculator to estimate growth, tax savings, total return, and balance at retirement with the option to contribute regularly. While there are no current-year tax benefits, your contributions and earnings can grow tax-free, and you can withdraw them tax-free and penalty free after age. Use this calculator to compute the amount you can save in a Roth IRA where you pay taxes on your income now, but withdraw the funds tax-free in retirement.

The Roth IRA can provide truly tax-free growth. Javascript is required The amount you will contribute to your Roth IRA each year. This calculator. For example, assuming a 10% current tax rate, a $ contribution to a Deductible Traditional IRA would equate to $50 in tax savings that year. The $50 is grown. If you pay taxes with money distributed from your IRA, you'll lose the benefits of potential tax-free growth on that amount within the Roth IRA. If you're under. Age at which you plan to retire. This calculator assumes that the year you retire, you do not make any contributions to your IRA. For example, if you retire at. For , the maximum annual IRA contribution is $7, which is a $ increase from Roth IRAs do not force a required minimum distribution. (RMD) be taken each year but they must be taken from a. Traditional IRA. How will these distributions. Tax-Free Growth: Contributions to a Roth IRA grow tax-free. · No Required Minimum Distributions (RMDs): Unlike traditional IRAs, Roth IRAs do not require RMDs. If you have Roth IRAs, your income could affect how much you can contribute. IRA, but your contributions will not be deductible. Contributions are. Even a relatively modest annual contribution of $1, starting at age 15 could grow to over $, by age 70, assuming an average. Should I open a Roth IRA? A Roth IRA can be an advantage to your overall retirement strategy, as it offers tax-free growth and withdrawals. It can help you. For , the maximum annual IRA contribution is $7, which is a $ increase from It is important to note that this is the maximum total contributed. Important: You can contribute to either or both types of IRAs for which you are eligible as long as your combined total contributions do not exceed the annual. A Roth IRA is an individual retirement account (IRA) you fund with after-tax dollars. Your investments have the potential to grow tax-free and may be withdrawn. Creating a Roth IRA can make a big difference in your retirement savings. The Roth IRA can provide truly tax-free growth The amount you will contribute to. For investors aged 50 and older, this maximum is increased to $8, To be eligible to contribute to a Roth IRA, your Modified Adjusted Gross Income (MAGI). A Traditional, SIMPLE, or SEP IRA account can accumulate $93, more after-tax balance than a Roth IRA account at age A Roth IRA account can accumulate. Roth IRA accounts are a special type of investment that allow your earnings to grow tax-free. In your Roth IRA account, you can invest up to $6, per year for. You cannot deduct contributions to a Roth IRA. · If you satisfy the requirements, qualified distributions are tax-free. · You can make contributions to your Roth. How does my income affect how much I can contribute? ROTH IRA The amount you can contribute to a Roth IRA: Can't exceed the amount of income you earned that. Take, just as an example, a Roth IRA that grows at an average rate of 7% to 10% each year. If it grows 7% a year and you start contributing the current maximum.

Latest Technology In Home Heating

:max_bytes(150000):strip_icc()/Lifesmart6ElementLargeRoomInfraredQuartzHeaterwWoodCabinetandRemote-591caa655f9b58f4c0e0d845.jpg)

Natural gas is currently the dominant heating source for homes in Massachusetts, although clean heating technologies have advanced in the Commonwealth. For homeowners who want the most efficient heating system available, heat pumps are the best candidate. They work by capturing heat and moving it from place to. Learn about the types of residential heating systems, such as furnaces and heat pumps, and how they compare in terms of energy efficiency and more. Invest in energy-efficient windows - Upgrading your windows to high-performance, energy-efficient models will improve the comfort of your home, as well as lower. In most climates, modern air source heat pumps provide the most efficient (and eco-friendly) solution for commercial, like-commercial and residential buildings. Quick Links · Air-to-water heat pumps · Boilers · Centrally-ducted heat pumps · Fireplaces · Furnaces · Heat pump wall units · Pellet stoves · Space heaters. A residential heating system warms the rooms in a home to keep its inhabitants comfortable in cold weather. The fuel type and system you choose to heat your. Modern cold-climate heat pumps are a smarter, more efficient, and environmentally friendly option to keep homes comfortable without using fossil fuels. Heat. This makes current models 3‐5 times more energy efficient than gas boilers. Heat pumps can be combined with other heating systems, commonly gas, in hybrid. Natural gas is currently the dominant heating source for homes in Massachusetts, although clean heating technologies have advanced in the Commonwealth. For homeowners who want the most efficient heating system available, heat pumps are the best candidate. They work by capturing heat and moving it from place to. Learn about the types of residential heating systems, such as furnaces and heat pumps, and how they compare in terms of energy efficiency and more. Invest in energy-efficient windows - Upgrading your windows to high-performance, energy-efficient models will improve the comfort of your home, as well as lower. In most climates, modern air source heat pumps provide the most efficient (and eco-friendly) solution for commercial, like-commercial and residential buildings. Quick Links · Air-to-water heat pumps · Boilers · Centrally-ducted heat pumps · Fireplaces · Furnaces · Heat pump wall units · Pellet stoves · Space heaters. A residential heating system warms the rooms in a home to keep its inhabitants comfortable in cold weather. The fuel type and system you choose to heat your. Modern cold-climate heat pumps are a smarter, more efficient, and environmentally friendly option to keep homes comfortable without using fossil fuels. Heat. This makes current models 3‐5 times more energy efficient than gas boilers. Heat pumps can be combined with other heating systems, commonly gas, in hybrid.

A residential heating system warms the rooms in a home to keep its inhabitants comfortable in cold weather. The fuel type and system you choose to heat your. A heat pump is an energy-efficient alternative to other types of home heating systems, such as a natural gas furnace or electric baseboards. Renewable energy is making considerable progress in the HVAC industry. Solar-powered HVAC systems and models that use home solar panels are gaining popularity. Home. Save With Clean Heating Heat and cool your 5+ unit building reliably all year long with the latest in efficient heating and cooling technology. A geothermal heat pump is the most cost-efficient option for new construction—providing central, whole-home heating and cooling and long-term, year-over-year. Air source heat pumps extract heating or cooling from outdoor air. Technology designed for cold climates can efficiently heat homes all winter across New York. Heat pumps help heat AND cool your home more efficiently by transferring heat (rather than producing it), all while lowering greenhouse gas emissions. Experience the all-in-one comfort and energy savings of high-efficiency heat pump technology that keeps your home warm in the winter and cool in the summer. One of the key advancements in furnace technology is the integration of artificial intelligence (AI) to enhance heat distribution and improve business. Comfort Heat Technology® – This technology maintains temperature consistency and uses the least amount of energy while meeting your needs and running quietly on. Hydrogenated-vegetable oil (or HVO) is a new fuel being used to replace kerosene, providing a cheaper and greener fuel for oil boiler customers. With conversion. Air source heat pumps extract heating or cooling from outdoor air. Technology designed for cold climates can efficiently heat homes all winter across New York. Heat pumps are the best of the best as far as HVAC options go. And if they're well maintained, they can last up to 15–25 years in a well-insulated home (1). Natural gas is currently the dominant heating source for homes in Massachusetts, although clean heating technologies have advanced in the Commonwealth. Hydronic heating systems use hot water to heat your home, providing comfortable radiant heat. These systems are more energy-efficient than air-based systems and. A heat pump uses technology similar to that found in a refrigerator or an air conditioner, but in reverse, extracting heat from a source, then transferring. Upgrading your home heating system may be as simple as replacing on old thermostat with a new digital, programmable one that enables you to flexibly customize. Greater Smart HVAC Technology for Homes Smart technology has already completely changed the HVAC industry. In , more homeowners are expected to embrace Wi. Hybrid systems are the most popular current trend in heating. These combine the energy-efficiency of a heat pump with the reliability of an electric or gas-. Today's heat pumps are making it possible for homes to stay more comfortable year-round, save energy, and reduce their carbon footprint. A heat pump is an all-.

Suing Someone For Personal Injury

However, in order to be eligible to proceed with the civil lawsuit, you must file a Notice of Claim within 90 days of the cause of action. Examples of. When the insurance settlement is too low to cover your expenses and bills, then you may choose to legally sue the other driver responsible for the accident. If. A personal injury claim is a formal request for compensation made directly to the at-fault party's insurance company. The injured person--or usually their. Try to settle or mediate your claim. If you are seriously injured, you'll almost always want to sue for more than the small claims maximum. But to gain a fair. If someone else is to blame for your injury, a personal injury lawsuit might be appropriate. Personal injury lawsuits are intended to return injured parties to. If you were injured and someone else is responsible for your harm, you have the right to file a claim with their insurance company. However, filing an insurance. Defending a personal injury lawsuit can be difficult, but your chances of lessening your responsibility is significantly better with our help. Before pointing the finger at another person, you need proof. You need direct and circumstantial evidence that they were at fault for your injuries. We will. Personal injury law can apply to any injury that one person or entity causes another person, so long as that injury was caused by intentional, negligent, or. However, in order to be eligible to proceed with the civil lawsuit, you must file a Notice of Claim within 90 days of the cause of action. Examples of. When the insurance settlement is too low to cover your expenses and bills, then you may choose to legally sue the other driver responsible for the accident. If. A personal injury claim is a formal request for compensation made directly to the at-fault party's insurance company. The injured person--or usually their. Try to settle or mediate your claim. If you are seriously injured, you'll almost always want to sue for more than the small claims maximum. But to gain a fair. If someone else is to blame for your injury, a personal injury lawsuit might be appropriate. Personal injury lawsuits are intended to return injured parties to. If you were injured and someone else is responsible for your harm, you have the right to file a claim with their insurance company. However, filing an insurance. Defending a personal injury lawsuit can be difficult, but your chances of lessening your responsibility is significantly better with our help. Before pointing the finger at another person, you need proof. You need direct and circumstantial evidence that they were at fault for your injuries. We will. Personal injury law can apply to any injury that one person or entity causes another person, so long as that injury was caused by intentional, negligent, or.

Making the decision to sue someone personally after a car accident isn't an easy choice. However, it can be the right choice if you feel that the driver's. Suing the Driver Individually. As an aggrieved party, you are legally entitled to file a claim against the at-fault driver for your incurred losses. Nonetheless. In a personal injury claim, the plaintiffs are the injured parties and their loved ones. They are the parties seeking compensation by holding the defendants. The first is liability; that is, legal responsibility for the accident. We need to prove that your injuries were the result of someone else's negligence; that. The at-fault driver may be held accountable with a personal injury lawsuit after a car accident. Claimants may also seek punitive damages in civil court. Through this type of claim, you can recover financial compensation for your medical expenses, lost wages, pain and suffering, and other losses. The process. Thirty days after you file your notice of claim and comply with the hearing demand you can file a lawsuit in court. Lawsuits must be filed in court within 1. Through this type of claim, you can recover financial compensation for your medical expenses, lost wages, pain and suffering, and other losses. The process. What Is a Bodily Injury Claim? If someone's carelessness caused your injuries, you could bring a bodily injury lawsuit. A personal injury claim requires you to. In many cases, only the person who was injured in an accident can file a lawsuit against the at-fault party. The person who files the lawsuit is known as the. If you want to make an injury claim (either through an insurance claim or lawsuit), you usually need to be able to prove that the person you are making the. You are under no obligation to seek representation. However, the process of investigating the claim and accident, filing the necessary rebuttal paperwork, and. In general, the exact nature of a person's liability depends on where the accident took place. If the accident occurred at work due to negligence, whether by. You can absolutely sue someone personally after a car accident that they caused. Talk to a lawyer to get started on your case today. For example, in a case for personal injury, you have to If you get into a car accident you would sue the person who was driving the car that hit you. A personal injury case arises when an individual suffers harm or injury because of another party's negligence, recklessness, or intentional actions. The injured. If there is a reasonable likelihood that your recovery will exceed $25,, you will file your lawsuit in Superior Court. Otherwise, your personal injury. Lawyers use medical records, photographs, videos, and testimony to convey how a person's life was affected by both physical injuries and emotional trauma. Many. The injured person or plaintiff writes a demand letter, stating the allegations and what the defendant did wrong and demands compensation for their injuries and. When you sue someone over a personal injury, you have to be able to prove that person was somehow negligent and, therefore, responsible for your injuries.