wstanley.ru

Learn

Is It Worth It To Invest In Cryptocurrency

Crypto is a long term play. Bitcoin may be far along its progression path now, but it is nowhere near reaching it potential. There are still. While many cryptocurrencies have dramatically increased in value since , they are still very risky and unpredictable assets. Their value can swing wildly. Cryptocurrency can be a great investment with astronomically high returns overnight; however, there is also a considerable downside. Investors should analyze. Due to the myriad of risks associated with Bitcoin and other digital currencies, investments should only be made with assets set aside for speculative purposes. Investing in the Trust comes with risks that could impact the Trust's share value, including large-scale sales by major investors, security threats like. Evaluating a cryptocurrency · Judging a cryptocurrency by market cap alone isn't recommended, but cryptocurrencies with a high market cap ($1 billion+) may be. Bitcoin, according to many, is still valued at a fraction of its true worth. Moreover, Bitcoin can still be purchased at a huge discount when compared to its. Cryptocurrencies tend to be more volatile than more traditional investments, such as stocks and bonds. An investment that's worth thousands of dollars today. Cryptocurrency's value stems from a combination of scarcity and the perception that it is a store of value, an anonymous means of payment, or a hedge against. Crypto is a long term play. Bitcoin may be far along its progression path now, but it is nowhere near reaching it potential. There are still. While many cryptocurrencies have dramatically increased in value since , they are still very risky and unpredictable assets. Their value can swing wildly. Cryptocurrency can be a great investment with astronomically high returns overnight; however, there is also a considerable downside. Investors should analyze. Due to the myriad of risks associated with Bitcoin and other digital currencies, investments should only be made with assets set aside for speculative purposes. Investing in the Trust comes with risks that could impact the Trust's share value, including large-scale sales by major investors, security threats like. Evaluating a cryptocurrency · Judging a cryptocurrency by market cap alone isn't recommended, but cryptocurrencies with a high market cap ($1 billion+) may be. Bitcoin, according to many, is still valued at a fraction of its true worth. Moreover, Bitcoin can still be purchased at a huge discount when compared to its. Cryptocurrencies tend to be more volatile than more traditional investments, such as stocks and bonds. An investment that's worth thousands of dollars today. Cryptocurrency's value stems from a combination of scarcity and the perception that it is a store of value, an anonymous means of payment, or a hedge against.

While Bitcoin has failed in its stated objectives, it has become a speculative investment. This is puzzling. It has no intrinsic value and is not backed by. Cryptocurrency can offer investors diversification from traditional financial assets such as stocks and bonds. While there's limited history on the price action. One can even buy real estate using bitcoin. 5 Several companies, in highly publicized moves, have invested millions of dollars in bitcoin. 6 The adoption of. Bitcoin may not be a good long-term investment given the market volatility of cryptocurrencies. Learn more about bitcoin. While not all cryptos are same, they all pose high risks and are speculative as an investment. You should never invest money into crypto that you can't afford. Because the value of GBTC is correlated with the value of Bitcoin, it is important to understand the investment attributes of, and the market for, the. crypto assets worth more than $16, into “investment pools” on the site. At some point, the victim believed their investment had doubled in value. But. Most experts warn that, in general, you should only invest as much money in cryptocurrency as you can afford to lose. And while cryptocurrencies, on the whole. The most persuasive reasons to invest in Bitcoin during and after the pandemic is that it acts as a strong hedge against fiat currency, central banks, and even. In contrast, stocks were never meant to be legal tender: A single share of Tesla is worth more than $1,, but you'd have a hard time buying a pizza with it. Investing in cryptocurrencies can still be a good idea, but it's essential to be aware of the risks. Cryptocurrencies have shown significant. Yes it is totally worth to invest in crypto. Don't feel that you are because it will keep compounding at the same rate. Crypto market still has. Additionally, cryptocurrency is not backed by any government or central bank. That means that there is no one to guarantee the value of your investment. The. Unlike other assets, trading cryptocurrency has very low barriers to entry with tokens with a range of values. Rising inflation has also caused many to invest. A cryptocurrency's value can change constantly and dramatically. An investment that may be worth thousands of dollars today could be worth only hundreds. Crypto is a high-risk investment. The value of crypto is very volatile, often fluctuating by huge amounts within a short period. Inflation dilutes the value of fiat currencies over time but doesn't have the same effect on cryptocurrencies in a conventional sense. Why? Because. Day trading is a short-term and high-risk strategy where crypto investors buy and sell cryptocurrencies on the same day to profit from rapid price swings. Cryptocurrency FAQs · The value of your cryptocurrency suddenly falls steeply – or is wiped out completely. · Your cryptocurrency, if not stored properly, gets. Is cryptocurrency a stable investment? The value of most cryptocurrencies all comes down to interest and demand. They're not tied to any one tangible asset.

What Bank Is Cash App Considered

With a Cash App Card, your funds are FDIC-insured through our partner banks, Wells Fargo Bank, N.A. and Sutton Bank, Members FDIC, for up to $, per person. Your Apple Cash balance lives on your Apple Cash card in the Wallet app. You can also transfer your Apple Cash to your bank account. If you have an. Cash App outsources basic banking functions to two FDIC-insured partner banks, Sutton Bank and Lincoln Savings Bank. Sutton Bank Cash App provides Prepaid Debit. No, but we are a FINTRAC-registered money services business, and we work closely with banking partners to keep deposits safe. This means we can offer a lot of. Cash App is a payment app where people can send and receive money instantly through a mobile device. Cash App is not a bank; it is a QR code payment platform. Since CashApp isn't a bank, it's not an option to be paid through. The funds would probably returned sometime. While we say goodby to summer, have a safe Labor. Looking for a bank behind Cash App? You won't find one. Cash App is a fintech app, not a bank. Two FDIC-insured partner banks handle all the transactions. All deposits held at U.S. banks are insured by the Federal Deposit Insurance Corporation (FDIC) up to $, By contrast, the balance of your Cash App. Cash App is a financial services platform, not a bank. Banking services are provided by Cash App's bank partner(s). Prepaid debit cards issued by Sutton. With a Cash App Card, your funds are FDIC-insured through our partner banks, Wells Fargo Bank, N.A. and Sutton Bank, Members FDIC, for up to $, per person. Your Apple Cash balance lives on your Apple Cash card in the Wallet app. You can also transfer your Apple Cash to your bank account. If you have an. Cash App outsources basic banking functions to two FDIC-insured partner banks, Sutton Bank and Lincoln Savings Bank. Sutton Bank Cash App provides Prepaid Debit. No, but we are a FINTRAC-registered money services business, and we work closely with banking partners to keep deposits safe. This means we can offer a lot of. Cash App is a payment app where people can send and receive money instantly through a mobile device. Cash App is not a bank; it is a QR code payment platform. Since CashApp isn't a bank, it's not an option to be paid through. The funds would probably returned sometime. While we say goodby to summer, have a safe Labor. Looking for a bank behind Cash App? You won't find one. Cash App is a fintech app, not a bank. Two FDIC-insured partner banks handle all the transactions. All deposits held at U.S. banks are insured by the Federal Deposit Insurance Corporation (FDIC) up to $, By contrast, the balance of your Cash App. Cash App is a financial services platform, not a bank. Banking services are provided by Cash App's bank partner(s). Prepaid debit cards issued by Sutton.

Yes, Cash App is among several person-to-person payment apps to which you can usually link a credit card to send money and to pay bills. The cash app account ID typically refers to the unique identifier associated with a user's account, which can be found in the app settings or on transaction. Learn just how easy it is to enable direct deposits into Cash App. Start utilizing Cash App for banking today. The Venmo Visa Credit Card is issued by Synchrony Bank pursuant to a license from Visa USA Inc. VISA is a registered trademark of Visa International Service. What bank does Cash App use? Cash App uses two US banks – Lincoln Savings Bank and Sutton Bank. Both banks are FDIC-insured up to $, Unfortunately. Yes, Cash App is among several person-to-person payment apps to which you can usually link a credit card to send money and to pay bills. Cash App is not a bank itself but rather partners with Sutton Bank, Lincoln Savings Bank, and Wells Fargo Bank to offer its services. All deposits held at U.S. banks are insured by the Federal Deposit Insurance Corporation (FDIC) up to $, By contrast, the balance of your Cash App. Cash App is a popular consumer app in the US that allows customers to bank, invest, send, and receive money using their digital wallet. Cash App Pay is a. No, Cash App is not a bank account in the USA. It is a mobile payment service that allows users to send and receive money, as well as make. Cash App (formerly Square Cash) is a mobile payment service available in the United States and the United Kingdom that allows users to transfer money to one. Debit cards issued by Sutton Bank pursuant to a license from Visa U.S.A., Inc. Visa is a registered trademark of Visa U.S.A., Inc. All other trademarks and. Cash App is a popular consumer app in the US that allows customers to bank, invest, send, and receive money using their digital wallet. Cash App Pay is a. CASH APP (SQUARE) · SQUARE CHECKING · Robinhood · Albert · Vanilla Gift: · Providers Card · GA Gateway Cash Cards. considered a criminal offense or The Company reserves the right to limit which banks or what types of accounts constitute an Eligible Bank Account. Cash App is a financial services platform; not a bank. Banking services provided by Cash App's bank partner(s). Prepaid debit cards issued by Sutton Bank. You may be familiar with Cash App already, formerly known as 'Square Cash'. The peer to peer payment app has been renamed and rebranded with a few new features. Cash App is a financial services platform, not a bank. Banking services are provided by Cash App's bank partner(s). Prepaid debit cards issued by Sutton Bank. Venmo, Cash App, and Zelle are all peer-to-peer mobile payment apps that allow users to transfer funds from a linked bank or credit union account to another.

Preferred Stock Etf Ex Financials

The Fund seeks to replicate as closely as possible the price and yield performance of the Wells Fargo Hybrid and Preferred Securities ex Financial Index. The. Preferred Securities ex Financials ETF information page, at Preferred Stock ChannelPreferred Securities ex Financials ETF. VanEck Preferred Securities ex Financials ETF ; Net Expense Ratio % ; Turnover % 27% ; Yield % ; Dividend $ ; Ex-Dividend Date Mar 1, VanEck PFXF ETF (VanEck Preferred Securities ex Financials ETF): stock price, performance, provider, sustainability, sectors, trading info. Dividends History for VanEck Preferred Securities ex Financials ETF (WKN A2AHNG, ISIN USF): all Ex Dates, Pay Dates, Payouts and Splits. PFXF - VanEck Preferred Securities ex Financials ETF - Stock screener for investors and traders, financial visualizations. The fund normally invests at least 80% of its total assets in securities that comprise the fund's benchmark index. The index is comprised of U.S. exchange-. Exchange-Listed Fixed & Adjustable Rate Non-Financial Preferred Securities Index (the "Preferred Securities Index"). The fund normally invests at least This index is comprised of convertible or exchangeable and non-convertible preferred securities listed on U.S. exchanges, excluding securities with a. The Fund seeks to replicate as closely as possible the price and yield performance of the Wells Fargo Hybrid and Preferred Securities ex Financial Index. The. Preferred Securities ex Financials ETF information page, at Preferred Stock ChannelPreferred Securities ex Financials ETF. VanEck Preferred Securities ex Financials ETF ; Net Expense Ratio % ; Turnover % 27% ; Yield % ; Dividend $ ; Ex-Dividend Date Mar 1, VanEck PFXF ETF (VanEck Preferred Securities ex Financials ETF): stock price, performance, provider, sustainability, sectors, trading info. Dividends History for VanEck Preferred Securities ex Financials ETF (WKN A2AHNG, ISIN USF): all Ex Dates, Pay Dates, Payouts and Splits. PFXF - VanEck Preferred Securities ex Financials ETF - Stock screener for investors and traders, financial visualizations. The fund normally invests at least 80% of its total assets in securities that comprise the fund's benchmark index. The index is comprised of U.S. exchange-. Exchange-Listed Fixed & Adjustable Rate Non-Financial Preferred Securities Index (the "Preferred Securities Index"). The fund normally invests at least This index is comprised of convertible or exchangeable and non-convertible preferred securities listed on U.S. exchanges, excluding securities with a.

SPDR® ICE Preferred Securities ETF · Global X US Preferred ETF · Invesco Preferred ETF · Invesco Variable Rate Preferred ETF · iShares Preferred&Income Securities. VanEck Preferred Securities ex Financials ETF. PFXF: NYSE. Arca. Historical stock and convertible preferred stock issued by non-financial corporations. VanEck Preferred Securities ex Financials ETF Data delayed at least 15 minutes, as of Aug 24 Use our fund screener to discover other asset types. Invest in VanEck Preferred Securities ex Financials (Dist), NYSE: PFXF ETF - View real-time PFXF price charts. Online commission-free investing in VanEck. The VanEck Preferred Securities ex Financials ETF (PFXF) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance. View VanEck Preferred Securities ex Financials ETF (PFXF) stock price today, market news, streaming charts, forecasts and financial information from FX. VanEck PFXF ETF (VanEck Preferred Securities ex Financials ETF): stock price, performance, provider, sustainability, sectors, trading info. Get the latest VanEck Preferred Securities ex Financials ETF (PFXF) real-time quote, historical performance, charts, and other financial information to help. Explore the latest news, in-depth analysis, performance evaluation, and Q&A for VanEck Preferred Securities ex Financials ETF (PFXF). View Vaneck Preferred Securities Ex Financials ETF (PFXF) ETF Profile from the issuer, including Top Holdings, Net Assets, Expense Ratio, and Shares. The index is comprised of U.S. exchange-listed hybrid debt, preferred stock and convertible preferred stock issued by non-financial corporations. The fund is. Learn everything about VanEck Preferred Securities ex Financials ETF (PFXF). Free ratings, analyses, holdings, benchmarks, quotes, and news. Explore PFXF for FREE on ETF Database: Price, Holdings, Charts, Technicals, Fact Sheet, News, and more. VanEck Preferred Securities ex Financials ETF (PFXF) - stock quote, history, news and other vital information to help you with your stock trading and. Get the latest VanEck Preferred Securities ex Financials ETF (PFXF) fund price, news, buy or sell recommendation, and investing advice from Wall Street. The VanEck Preferred Securities ex Financials ETF (PFXF) is an exchange-traded fund that mostly invests in broad credit fixed income. Member Sign In · VanEck Preferred Securities ex Financials ETF: (PFXF) · ETF Quote Details · Zacks Premium Research for PFXF · ETF Expense Ratio · Benchmark for. News · VanEck Vectors Preferred Securities Ex Financials ETF Declares Monthly Distribution of $ · VanEck Vectors Preferred Securities Ex Financials ETF To. ETF strategy - VANECK PREFERRED SECURITIES EX FINANCIALS ETF - Current price data, news, charts and performance. View the latest VanEck Preferred Securities ex Financials ETF (PFXF) stock price and news, and other vital information for better exchange traded fund.

Top Airlines To Fly

WORLD AIRLINE AWARD WINNERS Singapore Airlines is named the World's Best Cabin Crew at the World Airline Awards, and ranked No 2 in the world for. Iberia Airlines is the best airline to fly to Spain. Which airline is the best to travel to Barcelona? Turkish Airlines, Iberia, and. Qatar airways is by far the best. Other superior airlines include Emirates, Singapore, ANA, Japan Airlines, and Cathay Pacific. Note that some. According to the Skytrax website, Singapore Airlines ranks as the topmost airline, renowned for its high-class and excellent on-board services. 1 Emirates ; 2 Delta Air Lines ; 3 Singapore Airlines ; 4 Qatar Airways ; 5 Southwest Airlines. 1. Singapore Air Consistently ranked one of the top five airlines in the world and the best airline in Asia, Singapore Air pampers passengers in first and. AirAsia · Scoot · Volotea · Flynas · Transavia France · IndiGo · Vueling Airlines · airBaltic. Emirates Airlines places a premium on ensuring the utmost care and convenience for its business-class travelers. When flying with Emirates, expect a wide array. AAdvantage members can earn Loyalty Points and base miles for every American Airlines, American Eagle and codeshare flight operated by other airlines like. WORLD AIRLINE AWARD WINNERS Singapore Airlines is named the World's Best Cabin Crew at the World Airline Awards, and ranked No 2 in the world for. Iberia Airlines is the best airline to fly to Spain. Which airline is the best to travel to Barcelona? Turkish Airlines, Iberia, and. Qatar airways is by far the best. Other superior airlines include Emirates, Singapore, ANA, Japan Airlines, and Cathay Pacific. Note that some. According to the Skytrax website, Singapore Airlines ranks as the topmost airline, renowned for its high-class and excellent on-board services. 1 Emirates ; 2 Delta Air Lines ; 3 Singapore Airlines ; 4 Qatar Airways ; 5 Southwest Airlines. 1. Singapore Air Consistently ranked one of the top five airlines in the world and the best airline in Asia, Singapore Air pampers passengers in first and. AirAsia · Scoot · Volotea · Flynas · Transavia France · IndiGo · Vueling Airlines · airBaltic. Emirates Airlines places a premium on ensuring the utmost care and convenience for its business-class travelers. When flying with Emirates, expect a wide array. AAdvantage members can earn Loyalty Points and base miles for every American Airlines, American Eagle and codeshare flight operated by other airlines like.

We've got the 16 best airlines for you to choose from. The best airline for you will depend on where you're coming from and what your priorities for the trip. Currently, at least 19 airlines from 78 locations worldwide fly to Iceland's Keflavik International Airport. —Singapore Airlines. Excellent in-flight service, even in economy class. Modern aircraft with beautiful interiors. · —Cathay Pacific. Again. As the biggest airline in the world, American Airlines is also one of the most pet-friendly. For shorter flights, pets are invited to fly in the cabin with. Qatar Airways has grown to fly to over destinations across the world within a short period of time. Qatar Airways is known for service, modern aircraft, and. Air New Zealand reclaimed the top spot in wstanley.ru's ranking, known for its excellent safety record and innovative in-flight experiences. The. American Airlines (AA/AAL) is the largest and one of the most prominent airlines in the United States. With a rich history dating back to Air New Zealand reclaimed the top spot in wstanley.ru's ranking, known for its excellent safety record and innovative in-flight experiences. The. "Delta is the best airline to use because they care about you as a customer. They will do everything they can to make your flight as enjoyable as possible.". Airline Ratings is a platform for comparing and reviewing airlines. Find the best airlines for your next trip. This ultimate list of airlines that fly and from Iceland can help you out. You can find anything, from budget airlines, such as Wizzair, to Icelandic airlines. Best Airline ; 1. Alaska Airlines. % ; 2. Delta. % ; 3. Hawaiian Airlines. % ; 4. American Airlines. % ; 5. United Airlines. %. Largest Airlines in the US Based On Number Of Passengers Carried · American Airlines · Delta Airlines · Southwest Airlines · United Airlines · Air Canada · Alaska. Singapore Airlines. Singapore Airlines is one of the most respected travel brands around the world. Flying one of the youngest aircraft fleets in the world to. Emirates Airlines places a premium on ensuring the utmost care and convenience for its business-class travelers. When flying with Emirates, expect a wide array. According to the Skytrax website, Singapore Airlines ranks as the topmost airline, renowned for its high-class and excellent on-board services. Top Airlines, Airports & Air Transportation Companies · Filter Companies · American Airlines · Delta Air Lines · United Airlines · Southwest Airlines · JetBlue. Best Airline (Overall), Best First & Business Class, Best Economy Class, Best Frequent Flier Program, Best In-flight Entertainment. Qatar airways is one of the best airlines to fly to and fro Africa. One of its strong point is safety. It has some of the most spacious economy seats. It has.

401k Ira Account

IRA benefits. The biggest difference between a (k) and IRA is flexibility. You can open an IRA at most financial institutions, and the range of investments. In some plans and the Thrift Savings Plan (TSP), there are a few circumstances when you can contribute above the annual limits. In addition, the maximum. A rollover IRA is a retirement account that allows you to move money from your former employer-sponsored plan to an IRA—tax and penalty-free1—while keeping your. You can withdraw contributions at any time, without penalty. You can withdraw earnings, penalty-free at age 59½, or earlier for certain hardships, as long as. An individual retirement account (IRA) is a tax-advantaged account designed to help you save for retirement. Learn more about Traditional, Roth and SEP. Rollover Individual Retirement Accounts (IRAs) · Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum distribution, · Roll over. Yes, you can have a Roth IRA and a (k) if you're eligible for your employer's (k) plan and you qualify to contribute to a Roth IRA. You can contribute to both a (k) and an IRA, as long as you keep your contributions to certain limits. For , you can contribute up to $23, to a (k). A (k) is a feature of a qualified profit-sharing plan that allows employees to contribute a portion of their wages to individual accounts. IRA benefits. The biggest difference between a (k) and IRA is flexibility. You can open an IRA at most financial institutions, and the range of investments. In some plans and the Thrift Savings Plan (TSP), there are a few circumstances when you can contribute above the annual limits. In addition, the maximum. A rollover IRA is a retirement account that allows you to move money from your former employer-sponsored plan to an IRA—tax and penalty-free1—while keeping your. You can withdraw contributions at any time, without penalty. You can withdraw earnings, penalty-free at age 59½, or earlier for certain hardships, as long as. An individual retirement account (IRA) is a tax-advantaged account designed to help you save for retirement. Learn more about Traditional, Roth and SEP. Rollover Individual Retirement Accounts (IRAs) · Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum distribution, · Roll over. Yes, you can have a Roth IRA and a (k) if you're eligible for your employer's (k) plan and you qualify to contribute to a Roth IRA. You can contribute to both a (k) and an IRA, as long as you keep your contributions to certain limits. For , you can contribute up to $23, to a (k). A (k) is a feature of a qualified profit-sharing plan that allows employees to contribute a portion of their wages to individual accounts.

How do I convert to a Roth IRA? A Roth IRA Conversion could help grow your retirement assets federal income tax-free. To help you convert to a Merrill Edge Roth. No account fees or minimums to open Fidelity retail IRA accounts. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs), and. Distributions, or withdrawals, from traditional IRAs are treated as ordinary income and taxed accordingly when withdrawn after age 59½. For withdrawals before. Get a retirement plan that's right for your business. Small-business owners have unique needs when it comes to saving for their retirement and helping their. If your employer doesn't offer a plan, then an IRA can be a good start to your retirement savings and another opportunity for your earnings to grow tax-free. Individual Retirement Accounts (IRA) provide tax advantages for retirement savings. You can contribute each year up to the maximum amount allowed by the. Fidelity estimates that you may need 55%% of your pre-retirement income in retirement. An employer-sponsored savings plan, such as a (k), might not be. When deciding between an employer-sponsored plan and IRA, there may be important differences to consider, such as range of investment options, fees and expenses. When you leave an employer, you typically have four options for what do with your savings from a qualified employer sponsored retirement plan (QRP) such as a. Rollover IRAs: A way to combine old (k)s and other retirement accounts · Leave your money in your former employer's plan, if your former employer permits it. Key takeaways · You can contribute to a Roth IRA (a type of individual retirement plan) and a (k) (a workplace retirement plan) at the same time. · Anyone. They all offer tax benefits for your retirement savings, like the potential for tax-deferred or tax-free growth. The key difference between a traditional and a. While contributing to both a (k) and IRA is certainly allowed, there are a few considerations to keep in mind. The first is the contribution limits the IRS. An IRA is an individual retirement account. Taxes With K or Traditional IRAs. No matter the type of retirement account you choose to open, there will likely. Combining (k)s and other retirement accounts in one place simplifies your finances, lowers administrative fees, and protects your retirement savings. While contributing to both a (k) and IRA is certainly allowed, there are a few considerations to keep in mind. The first is the contribution limits the IRS. If you've worked at several jobs, you may have a few k-type plans from previous employers plus your own IRA accounts. Managing all those accounts can be a. Making the most of your retirement accounts Given their similar tax benefits, both (k) plans and IRAs can help you reach your financial goals. A (k) is. Based on your situation, you can determine whether to continue adding money to your (k) and/or open an IRA. You can open an IRA at most banks and investment.

Roth Ira Trade Options

:max_bytes(150000):strip_icc()/Investing-Tips-for-Better-Investment-Results-57a528a05f9b58974aad1aec.jpg)

You must have enough money in your settlement fund to cover your purchase when you place an order. You can't place an order and fund it later. The trade will. What is the difference between traditional and Roth IRA accounts? How do I Why trade options? If you have a complex portfolio, you may find options. Learn how to trade options within IRAs and other tax advantaged accounts, and view potential strategies to use for different account types. IRAs and brokerage accounts both offer flexibility and control in terms of investment options. These include the ability to invest in stocks, bonds, mutual. In an IRA, you can trade stocks, ETFs, mutual funds, and fixed income products such as bonds or CDs. Because industry regulations prohibit IRA accounts from. Online trades are $0 for stocks, ETFs, options and mutual funds. See our Pricing page for detailed pricing of all security types offered at Firstrade. All. It's not a good idea, unless you are a super skilled options trader. That is maybe 5–10% of all traders. Do the math. Are you one of those? Yes, you can sell options in a ROTH IRA, but most brokers require the trade to be cash-secured. You can sell cash-secured. You have a variety of options when it comes to what you can trade in your tastytrade Roth IRA. Stocks, options, and futures are all available to trade with IRA. You must have enough money in your settlement fund to cover your purchase when you place an order. You can't place an order and fund it later. The trade will. What is the difference between traditional and Roth IRA accounts? How do I Why trade options? If you have a complex portfolio, you may find options. Learn how to trade options within IRAs and other tax advantaged accounts, and view potential strategies to use for different account types. IRAs and brokerage accounts both offer flexibility and control in terms of investment options. These include the ability to invest in stocks, bonds, mutual. In an IRA, you can trade stocks, ETFs, mutual funds, and fixed income products such as bonds or CDs. Because industry regulations prohibit IRA accounts from. Online trades are $0 for stocks, ETFs, options and mutual funds. See our Pricing page for detailed pricing of all security types offered at Firstrade. All. It's not a good idea, unless you are a super skilled options trader. That is maybe 5–10% of all traders. Do the math. Are you one of those? Yes, you can sell options in a ROTH IRA, but most brokers require the trade to be cash-secured. You can sell cash-secured. You have a variety of options when it comes to what you can trade in your tastytrade Roth IRA. Stocks, options, and futures are all available to trade with IRA.

Buying Power Requirements for IRA Futures Trading · Long options on futures: Debit paid · Short options on futures: 2X SPAN Margin Requirement · Long/short options. TradeStation's Traditional and Roth IRAs allow you to actively invest your retirement savings. This means you can choose how you want to maximize your. U.S. stock index funds U.S. stock index funds are some of the best investments for a Roth IRA. S&P index funds are popular choices. “By doing the S&P, you. An E*TRADE Roth IRA lets you invest your way. Our Roth IRA Options and Risk Disclosure Statement for Futures and Options before you begin trading options. What options strategies can you trade in an individual retirement account (IRA)?. Options trading on IRAs includes: Buy-writes; Selling covered calls; Rolling. Commission-free online trades apply to trading in U.S. listed stocks, Exchange-Traded Funds (ETFs), and options. Option trades are subject to a $ per-. Futures margin trading in an Individual Retirement Account (IRA) is subject to substantially higher margin requirements than in a non-IRA margin account. Margin. In a lower tax bracket · Wanting more spendable income · Ready to invest at least $1, · Needing flexibility · Nearing retirement · Not sure which IRA is right for. Find out how you should be trading in your IRA to reduce your cost basis and improve your probabilities Replacing Buying & Selling Stock with Options. Aug Trade options with zero-commissions and per-contract fee of just $ LEVEL 1Available in general investment and IRA accounts. Covered calls; Cash. An E*TRADE Roth IRA lets you invest your way. Our Roth IRA Options and Risk Disclosure Statement for Futures and Options before you begin trading options. Nevertheless, I will still point out that trading options in an IRA - Traditional or Roth - has one huge advantage over trading options in regular non-. This includes Traditional, Rollover, Roth, Simple, and SEP IRAs. Where most investors can't trade options is in their employer-sponsored retirement plans like a. And account holders pay $0 commissions for online US-listed stock, ETF, mutual fund, and options trades. E*Trade also offers a long list of investment options. Free trading of stocks, ETFs, and options refers to $0 commissions for Webull Financial LLC self-directed individual cash or margin brokerage accounts and IRAs. The major tax advantage of using a Self-Directed IRA or Roth IRA to invest in short-term options is that the gains are tax-free. There is no need to worry. That being said, it is possible to engage in trading in an IRA. However, anyone wishing to do so should keep in mind the prohibited transactions. When it comes. $0 option trades are subject to a $ per-contract fee. Other fees and restrictions may apply. Pricing is subject to change without advance notice. For broker. With a WellsTrade IRA you'll be empowered to invest the way you want. Wells Fargo Advisors offer Traditional, Roth, and SEP IRAs. Roth IRA for Kids is not eligible for spread trading. Applying for Margin. • Option Tiers 2 and 3 require margin to be set up on your account. If you apply for.

Crypto Fear And Greed

Bitcoin Fear and Greed Index is Fear Current price: $57, · 40 · 14K ; Bitcoin Fear and Greed Index is 26 — Fear Current price: $58, · · 32K. The Bitcoin Fear and Greed Index is a sentiment analysis tool for Bitcoin and crypto markets, indicating when markets are overly fearful. Extreme fear could be a buying opportunity because investors are too worried. · Extreme greed could mean that investors are too greedy and the market is due for. The Crypto Fear and Greed index captures market mood through five essential elements. Volatility (25%) and market momentum/volume (25%) shed points on the. Crypto - Fear & Greed Index Sign up now to view more! Composed of crypto price indicators, social media keywords, Bitcoin proportion, and Google searches;. Crypto Fear and Greed index is a high-level signal of the overall market sentiment for Bitcoin. This index generates a score anywhere between 0 and Warren Buffett, a trading veteran and prominent figure in the fear and greed discourse, famously said that people should "be fearful when others are greedy and. The Fear & Greed Index is a way to gauge market movements and whether assets are fairly priced. The theory is based on the logic that excessive. The Fear and Greed Bitcoin Index measures how scared or greedy investors are with respect to Bitcoin. By analyzing market sentiment, the index provides valuable. Bitcoin Fear and Greed Index is Fear Current price: $57, · 40 · 14K ; Bitcoin Fear and Greed Index is 26 — Fear Current price: $58, · · 32K. The Bitcoin Fear and Greed Index is a sentiment analysis tool for Bitcoin and crypto markets, indicating when markets are overly fearful. Extreme fear could be a buying opportunity because investors are too worried. · Extreme greed could mean that investors are too greedy and the market is due for. The Crypto Fear and Greed index captures market mood through five essential elements. Volatility (25%) and market momentum/volume (25%) shed points on the. Crypto - Fear & Greed Index Sign up now to view more! Composed of crypto price indicators, social media keywords, Bitcoin proportion, and Google searches;. Crypto Fear and Greed index is a high-level signal of the overall market sentiment for Bitcoin. This index generates a score anywhere between 0 and Warren Buffett, a trading veteran and prominent figure in the fear and greed discourse, famously said that people should "be fearful when others are greedy and. The Fear & Greed Index is a way to gauge market movements and whether assets are fairly priced. The theory is based on the logic that excessive. The Fear and Greed Bitcoin Index measures how scared or greedy investors are with respect to Bitcoin. By analyzing market sentiment, the index provides valuable.

the bitcoin fear & greed index, pulling in from wstanley.ru's crypto fear and greed index API. Crypto Fear and Greed Index. The market sentiment Indicator. When it's Fearful might be a good moment to consider to buy, when it's Greedy might be a good. How do I use the crypto Fear and Greed Index? Be fearful when others are greedy, and greedy when others are fearful. Economists use the term 'animal spirits. The Crypto Fear and Greed Index is a tool that gauges the market sentiment of cryptocurrencies, providing a score from 0 to · The index utilizes various. The index ranges from 0 (Extreme Fear) to (Extreme Greed), reflecting crypto market sentiment. A low value signals over-selling, while a high value warns. The crypto fear and greed index is a popular indicator that measures the emotions of market participants. It ranges from 0 to , with lower values indicating. The crypto fear and greed index is a distillation of key data sources meant to analyze market sentiment and offer a single dependable figure. This analysis can. “Fear and Greed - Crypto” brings you the ability to observe the market sentiment in real time in an easy to use app. Furthermore, the app stores historical. Are you looking to learn more about the latest stock market info, and crypto currency info? Maybe you want access Bitcoin fear & greed index, stock market. Bitcoin Fear and Greed Index is 26 — Fear Current price: $ The Crypto Fear & Greed Index is an indicator from wstanley.ru that aims at capturing investor sentiment in a single number by incorporating data from. Latest Fear and Greed Index score and live chart that updates every day so you can understand market sentiment. Plus an explanation of how to use the Fear. TURN NOTIFICATIONS ON Joined July 13 Following · K Followers · Posts · Replies · Media. Bitcoin Fear and Greed Index's posts. The original Fear & Greed Index is a key market indicator developed by CNN Money to measure how these two human emotions affected the stock market. A falling market makes them fearful, resulting in panic sales, while a bull market makes them greedy, and they start accumulating. The Crypto Fear and Greed. CNN's Fear & Greed Index is a way to gauge stock market movements and whether stocks are fairly priced. The index uses seven market indicators to help. Crypto Fear & Greed Index Over Time. This is a plot of the Fear & Greed Index over time, where a value of 0 means "Extreme Fear" while a value of This includes examining the daily closing prices and volumes of Bitcoin, as well as the Fear and Greed Index values for the overall crypto market. Through. What Is Fear & Greed Index? · Greed means that traders and investors feel too greedy. This may indicate that the market is due for a correction. · Fear means that. See the market at a glance with our live crypto charts and market data. Fear and Greed Index. Bitcoin dominance. Total market cap. 24h volume.

Youtube Tv Youtube Music Bundle

So, YouTube TV is $1, cheaper per year than DirecTV. I did not include the cost of my internet connection in my DirecTV cost or my streaming. After paying for Google Music and then YouTube Music for years for my family But there's still no kind of Bundle Price or awareness that lot's of families. YouTube and YouTube Music ad-free, offline, and in the background. 1-month trial for $0. Then $/month. Cancel anytime. Live streaming platform YouTube TV is offering its subscribers a $65 monthly subscription fee. This amount will provide access to the 90 most popular video. Get the best deals on YouTube Premium 12 Months - YouTube Account - GLOBAL at the most attractive prices on the market. Don't overpay – buy cheap on G2A. A new music service with official albums, singles, videos, remixes, live performances and more for Android, iOS and desktop. It's all here. This YouTube Premium 3 month free trial promotion is only open to YouTube TV subscribers in the United States that have made at least 1 valid payment. Stream live TV from ABC, CBS, FOX, NBC, ESPN & popular cable networks. Record without DVR storage space limits. Try it free. Cancel anytime. The answer is no. Subscribers to YouTube TV can't enjoy ad-free YouTube Music. YouTube TV allows users to watch cable channels and networks over an internet. So, YouTube TV is $1, cheaper per year than DirecTV. I did not include the cost of my internet connection in my DirecTV cost or my streaming. After paying for Google Music and then YouTube Music for years for my family But there's still no kind of Bundle Price or awareness that lot's of families. YouTube and YouTube Music ad-free, offline, and in the background. 1-month trial for $0. Then $/month. Cancel anytime. Live streaming platform YouTube TV is offering its subscribers a $65 monthly subscription fee. This amount will provide access to the 90 most popular video. Get the best deals on YouTube Premium 12 Months - YouTube Account - GLOBAL at the most attractive prices on the market. Don't overpay – buy cheap on G2A. A new music service with official albums, singles, videos, remixes, live performances and more for Android, iOS and desktop. It's all here. This YouTube Premium 3 month free trial promotion is only open to YouTube TV subscribers in the United States that have made at least 1 valid payment. Stream live TV from ABC, CBS, FOX, NBC, ESPN & popular cable networks. Record without DVR storage space limits. Try it free. Cancel anytime. The answer is no. Subscribers to YouTube TV can't enjoy ad-free YouTube Music. YouTube TV allows users to watch cable channels and networks over an internet.

Nope, Premium and YouTube TV are 2 completely different things so they are not bundled together.

Switch to a Verizon Home Internet plan. Then add YouTube TV for $/mo $/ mo + tax. New subscribers only. Ends YouTube TV is now the exclusive home of NFL Sunday Ticket. Watch every out-of-market Sunday game* on your TV and supported devices. Watch cable-free live TV. Stream live TV from ABC, CBS, FOX, NBC, ESPN & popular cable networks. Record without DVR storage space limits. Try it free. Cancel anytime. With Kinetic Internet and YouTube TV, watch entertainment from your favorite channel with the freedom and flexibility you want, for a great price. YouTube Premium gives you YouTube and YouTube Music ad-free, offline, and in the background. YouTube Premium isn't included in your YouTube TV membership. Learn how to activate your YouTube Premium Perk for $10/mo when you have select mobile or home internet plans. Features uninterrupted YouTube & music. But there's still no kind of Bundle Price or awareness that lot's of families still use Googles Workspace. tidal as Music Streaming Service. Youtube can't be. YouTube Music is a music streaming service developed by the American video platform YouTube, a subsidiary of Google. The service is designed with a user. Compare Television plans, pricing, pros and cons, features and first-hand reviews from current ESPN+ and YouTube TV customers. With YouTube Premium you get uninterrupted access to stream all you want on the YouTube Music app. Listen to the world's largest music catalog with over I chose YouTube TV precisely because of the access to the regional sports networks NBC owns. At the time, there was no other option to get those channels. YouTube TV. Live TV from 85+ top channels. Record with unlimited DVR space YouTube Music included. Download videos for offline viewing. Play even if. YouTube TV is a live TV streaming service with major broadcast and popular cable networks. YouTube Premium gives you YouTube and YouTube Music ad-free, offline. YouTube Music Premium is the ad-free option, offering unlimited streaming at a cost of $ a month. When they don't have much going on I drop them and resubscribe when they have something I want to watch, I also look for sales and bundles to. YouTube Music app tile. Everything you. stream, all on. one screen YouTube TV is a subscription streaming service which offers access to +. YouTube knows that students study hard and play hard, too. So, they're offering a special discount on streaming for music and movies just for students. Offer only available to users who are not currently YouTube Premium or YouTube Music Premium subscribers, have not been YouTube Premium, YouTube Music Premium. TV & Home Theater · Computers & Tablets · Video Games · Audio · Cell Offer only available to users who are not currently YouTube Premium or YouTube Music.

Credit Score Required For Car Loan

.png)

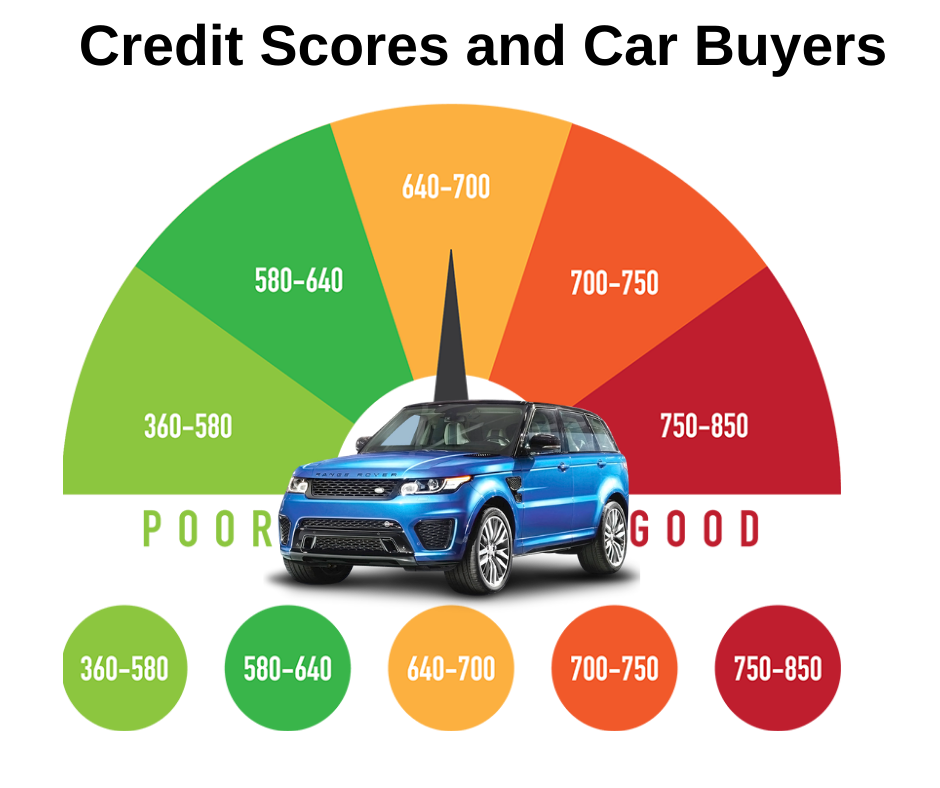

In order to receive a lower interest rate on an auto loan, you must have a good credit score. According to Experian, a good credit score is or above. While there is no proper credit score to finance a car, most Black Mountain dealerships will work with drivers who have bad credit or no credit. Generally speaking, banks require a minimum credit score of to give an auto loan without any down payment. However, you CAN buy a car with a score of While specific credit score requirements may vary among lenders, having a good credit score can increase your chances of securing favorable car financing terms. Generally speaking, banks require a minimum credit score of to give an auto loan without any down payment. However, you CAN buy a car with a score of Good credit history and a good credit score can certainly improve your chances of getting an auto loan with a low loan interest rate. However, it's possible to. Not what you want to hear but car loans are scored on what is called an industry enhanced score, and for auto loans that I can promise you. You can get a vehicle with a wide range of credit scores, but the average for a new vehicle is and the average for a used vehicle is Theaverage credit score to finance a car is , but every credit score is grouped into one of five categories. In order to receive a lower interest rate on an auto loan, you must have a good credit score. According to Experian, a good credit score is or above. While there is no proper credit score to finance a car, most Black Mountain dealerships will work with drivers who have bad credit or no credit. Generally speaking, banks require a minimum credit score of to give an auto loan without any down payment. However, you CAN buy a car with a score of While specific credit score requirements may vary among lenders, having a good credit score can increase your chances of securing favorable car financing terms. Generally speaking, banks require a minimum credit score of to give an auto loan without any down payment. However, you CAN buy a car with a score of Good credit history and a good credit score can certainly improve your chances of getting an auto loan with a low loan interest rate. However, it's possible to. Not what you want to hear but car loans are scored on what is called an industry enhanced score, and for auto loans that I can promise you. You can get a vehicle with a wide range of credit scores, but the average for a new vehicle is and the average for a used vehicle is Theaverage credit score to finance a car is , but every credit score is grouped into one of five categories.

To get an auto loan without a high interest rate, our research shows you'll want a credit score of or above on the to point scale. That's. You can probably get a loan with a very low credit score. But expect to pay a higher interest rate. Here's how the interest rates break out for new cars by. You can recover from bad credit through simple creditworthy behavior, such as paying your bills on time. And as this review of auto loans for a to What Credit Score Do You Need To Get A Car Loan? Many lenders require a credit score above to get a standard car loan. However, if you have a credit score. There is no minimum credit score to apply for an auto loan, but higher scores typically make you eligible for lower interest rates. You can increase your credit. In short, there is no set-in-stone credit score to get a car loan. A poor credit score is not an automatic disqualifier, but it will likely impact your ability. is a good credit score to get a car loan. but in case of bad credit, you may able to get a car with a credit score but with a higher. In most cases, a credit score of around or higher is needed for approval. But if you don't have good credit, don't worry: at Greater Nevada, we offer loan. Credit score requirements vary greatly by lender, so there's no national minimum credit score you need to get an auto loan. However, as a general rule, if you. To secure a car loan with favorable terms and interest rates for your next Bloomington ride, it's recommended to aim for a credit score of at least or. Documentation Requirements. Whether your credit score is or , you will need to provide your lender with some documentation proving your ability to repay. But again, there is no minimum credit score for a car loan. Even people with bad credit can get a car loan, which is discussed in the article “How to Get a Car. Generally, a good credit score is above or If your credit score isn't very high, and you don't need a new car right away, you may want to take. IT PAYS TO HAVE A GOOD SCORE: ; $20,, 60 months, + ; $20,, 60 months, ; $20,, 60 months, ; $20,, 60 months, When it comes to your credit score and your auto loan, it is a consistent flow of giving and taking. For instance, if your credit score is deep subprime and you. Generally, lenders will consider the credit score of all applicants applying for a loan. Different lenders use different methods for assessing the. Lenders offering car loans to people with a credit score may have specific requirements, such as a stable income, a down payment, or a co-signer to mitigate. SCCU guidelines include an auto loan credit score of at least To boost your credit scores (it can take a bit of time). Make all payments on time; it can. Car dealers quite literally need to sell cars. It's their job. So, even if your credit score is in the deep subprime range () you can get a car loan. As of late, the average credit score needed to take out an auto loan on a new car is , and for a used car. With that said, many Valrico shoppers are able.

How Many Capital One Cards Can You Have At Once

And after you spend $ on purchases within 3 months from account opening, you will earn a one-time $ cash bonus. There is a $0 annual fee, and the card. Once you review the different types of cards available, you may want to ask yourself the following questions: What are your financial goals? Credit cards can. Some experts recommend two or three credit cards, as long as you use them responsibly. But your number ultimately depends on your personal situation. You typically won't get as many benefits as you would with a premium credit card, but you can still find worthwhile perks. For example, having a card with no. Compare Guaranteed secured, Guaranteed and rewards credit cards. We have options for Canadians who are looking to build credit or earn rewards. Travel smarter with Capital One at every step of the journey, including booking flights, hotels and rental cars. Get more from your next journey with. Although the issuer limits you to having two personal credit cards at a time, Capital One business cards (and cobranded cards) aren't included in this limit. No annual or hidden fees, and you can earn unlimited % cash back on every purchase, every day. · Put down a refundable $ security deposit to get a $ Learn how to link Capital One credit card accounts online and manage all of your credit cards easily in one place. And after you spend $ on purchases within 3 months from account opening, you will earn a one-time $ cash bonus. There is a $0 annual fee, and the card. Once you review the different types of cards available, you may want to ask yourself the following questions: What are your financial goals? Credit cards can. Some experts recommend two or three credit cards, as long as you use them responsibly. But your number ultimately depends on your personal situation. You typically won't get as many benefits as you would with a premium credit card, but you can still find worthwhile perks. For example, having a card with no. Compare Guaranteed secured, Guaranteed and rewards credit cards. We have options for Canadians who are looking to build credit or earn rewards. Travel smarter with Capital One at every step of the journey, including booking flights, hotels and rental cars. Get more from your next journey with. Although the issuer limits you to having two personal credit cards at a time, Capital One business cards (and cobranded cards) aren't included in this limit. No annual or hidden fees, and you can earn unlimited % cash back on every purchase, every day. · Put down a refundable $ security deposit to get a $ Learn how to link Capital One credit card accounts online and manage all of your credit cards easily in one place.

you'll get Capital One's best prices on thousands of trip options; Miles won't expire for the life of the account and there's no limit to how many you can earn. Very broadly speaking, most card issuers will only approve you for one card in a day, so if you're going to apply for multiple cards, make sure they're with. There's a limit of two "starter" cards- Journey, Platinum, maybe Quicksilver. There's a limit of five prime cards- Venture and Savor. While there's generally no rule against applying for multiple credit cards at the same time, it may have a temporary effect on your credit scores. you can call the number on the back of your card. Please note that to add an If you're approved, you should receive your Capital One card, credit. It's easy to apply. Just enter your Reservation Number and Access Code from your letter/E-mail to start your secure application. You could get a response in. Well in light of Capitol One's nonsense, they will approve you for their platinum card and limit and unlike the tier 1 guys who contact. What information will you need from me to apply for a Capital One credit card? Why do you need to know how long I've been at my address? Is it safe to apply. This could mean you're less likely to be offered a credit limit increase. having to pay it all back at once. Plus, you'll automatically get up to Card will grant you priority boarding on Avelo flights for the first year Earn 75K Bonus Miles. Earn 75, bonus miles with your Capital One Venture Card. However, knowing which travel credit card(s) to apply for can be confusing. Below you will find every card from Capital One, ranked by what we believe to be the. However, there is no simple answer as to how many credit cards you should have, and there can even be advantages to having more than one credit card. Most. The 2/3/4 rule: According to this rule, applicants are limited to two new cards in a day period, three new cards in a month period and four new cards in a. Well in light of Capitol One's nonsense, they will approve you for their platinum card and limit and unlike the tier 1 guys who contact. But issuers must tell you their decision within 30 days. Once you've been approved, many credit card issuers, including Capital One, say you can expect to. Annual fees: Many Capital One cards have an annual fee. However, some business cards waive the fee in the first year or can easily be offset. You're tenacious and driven, so the last place you want to work is some boring bank. Same. Learn about careers at Capital One and view jobs here. Your credit limit will be equal to your security deposit. The minimum requirement for the Quicksilver Secured is $, but you can go as high as $1, to. you'll get Capital One's best prices on thousands of trip options; Miles won't expire for the life of the account and there's no limit to how many you can earn. It's easy to apply. Just enter your Reservation Number and Access Code from your letter/E-mail to start your secure application. You could get a response in as.