wstanley.ru

Community

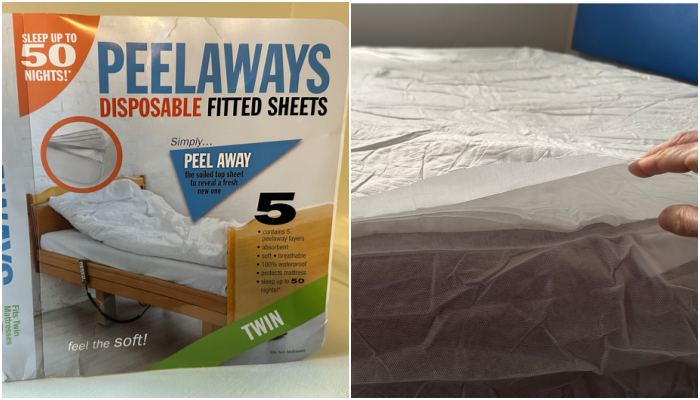

Peel Away Bed Sheets

This cool dorm bedding supply features seven layers of twin XL fitted, disposable, recyclable sheets. The sheet layers are made from a waterproof polyester. So. Manufacturer of patented disposable bedding products intended to help change sheets easily. The company specializes in sheet technology that uses multiple soft. 32% softer than traditional sheets – less friction; 45% manufactured from plant-based materials; % waterproof and disposable; Reduces infection spread. 5 likes · peelaways. Say goodbye to laundry day and hello to more time for the things you love with Peelaways disposable bed sheets! #Peelaways. Kids-A-Peel Disposable Fitted Sheets by Delta Children are the smarter alternative to traditional bedding—they are waterproof fitted sheets with 6 peel away. Peelaways are multi-layered, disposable bed sheets. Caregivers can simply peel away the top layer to reveal a fresh, clean sheet below. An unbelievably soft and disposable bed sheet, PEELAWAYS allows you to simply tear off the dirty layer without a trip to the washing machine. Peel Away Labs produces DORM-A-PEEL, CAMP-A-PEEL, CRIB-A-PEEL and PEEL-AWAYs that come in seven sizes: crib, cot, twin, twin XL, full, queen and. This cool dorm bedding supply features seven layers of twin XL fitted, disposable, recyclable sheets. The sheet layers are made from a waterproof polyester. So. This cool dorm bedding supply features seven layers of twin XL fitted, disposable, recyclable sheets. The sheet layers are made from a waterproof polyester. So. Manufacturer of patented disposable bedding products intended to help change sheets easily. The company specializes in sheet technology that uses multiple soft. 32% softer than traditional sheets – less friction; 45% manufactured from plant-based materials; % waterproof and disposable; Reduces infection spread. 5 likes · peelaways. Say goodbye to laundry day and hello to more time for the things you love with Peelaways disposable bed sheets! #Peelaways. Kids-A-Peel Disposable Fitted Sheets by Delta Children are the smarter alternative to traditional bedding—they are waterproof fitted sheets with 6 peel away. Peelaways are multi-layered, disposable bed sheets. Caregivers can simply peel away the top layer to reveal a fresh, clean sheet below. An unbelievably soft and disposable bed sheet, PEELAWAYS allows you to simply tear off the dirty layer without a trip to the washing machine. Peel Away Labs produces DORM-A-PEEL, CAMP-A-PEEL, CRIB-A-PEEL and PEEL-AWAYs that come in seven sizes: crib, cot, twin, twin XL, full, queen and. This cool dorm bedding supply features seven layers of twin XL fitted, disposable, recyclable sheets. The sheet layers are made from a waterproof polyester. So.

PEELAWAYS SINGLE-LAYER BED SHEET (Peel Away Labs). Beds & Bed Related Changing sheets with a person lying in bed goes from 15 minutes to a minute or. Beds & Mattresses, Linens & Bedding, Fitted Sheets. Introducing Camp-A-Peel with Cot Size, which comes with 7-layer disposable bed sheets. Just peel away. Medical Tourism Magazine recently sat with Maxwell Cohen, Founder and CEO of Peel Away Labs, to talk about his product, 'peel-away' bedsheets, and how it can. Sleep on our disposable fitted bed sheets for days (or until soiled) the simply peel back a layer and throw away! Instantly, you have a clean and. Peel Away Fitted Sheets() · Fitted Sheet Only - 4-Way Stretch, Snug Fit, Wrinkle Free & Stay in Place, No Slipping Off Fitted Sheet · Going Away Party Fitted. peel away disposable bed sheets, bed wetting sheets, disposable sheets, bedding, water resistant sheets, Amazon finds, Walmart finds, amazon must haves. Peelaways are a plus for adults, seniors, college students, babies and healthcare providers.” By simply pulling down the sheet from one corner, a soiled sheet. Twin XL: 80 x 39 x 9 inches; Peel-Aways fits standard hospital mattresses and can also be used as a mattress pad; Changing sheets with a person lying in bed. sheets back to the dorm and remake the bed. Or, the student can send it out which can take a week to get back, so the student needs a second set of bed sheets. Peelaways Fitted Bedsheet with 5 Peel Away Top Layers Twin XL Dorm Camping () ; Quantity. 1 available ; Item Number. ; Brand. Peelaway Labs. PeelAways are multi-layer disposable bed sheets that are soft, breathable, and % waterproof. These features ensure a durable and long-lasting solution, with. With multi-layered waterproof sheets you could change the sheets in 60 seconds without stripping the bed, while keeping your loved ones comfortable. Avoid the. JERSEY CITY, N.J., August 1, - Clean, soft sheets are now less than 60 seconds away. After more than three years in development, Peel Away Labs' %. Sheets · Bed Sheet.,for, Item ID-; #; Peel Away Labs # Bed Sheet Peelaways Fitted Sheet 80 L X 39 W X 9 Inch White Disposable. SHEET, BED SINGLE. Peelaways™ are the smarter alternative to traditional bedding: the first multi-layered peel away disposable bed sheets. Bed Pads that Protect Your Mattress. 37 reviews. This Product Is No Longer bedding—they are waterproof fitted sheets with 6 peel away layers. Perfect. Maxwell Cohen's board "Peel Away Labs ~ Shark Tank Product", followed by people on Pinterest. See more ideas about shark tank, peel, bed sheets. The Next Generation in Bedding. Peel Away Labs specializes in sheets. Thecompany has applied a new technologyto design a solution that benefits both. Delivery - Weeks, Directly Ships from the Manufacturer Item Id MF ID Brand Peelaways Manufacturer Peel Away Labs Application Bed Sheet Color.

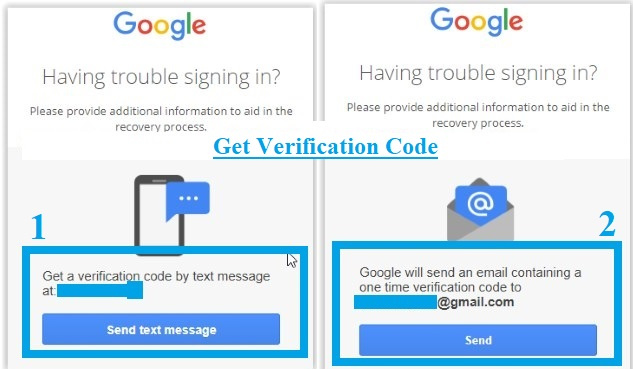

Gmail Linked To Phone Number

Add a phone number to your email signature · Select the newly added phone number (it should be highlighted in blue) · Click the Link icon in the signature editor. On any Google sign-in screen with an "Email or phone number" field, enter your phone number. · Select Next. · Finish signing in as you usually do. I was wondering if there is any way to at least view the gmail accounts under my phone number. When I try to send email as HTML the Gmail is automatically generating a blue link (hyperlink to google map). I have used below solution (css). Find your email. Enter your phone number or recovery email. Phone number or email. Next. Family Link. arrow_drop_down Toggle Google Fi Wireless. Google Fi Add a recovery phone number and email address to your account. If you use 2. Sign in. Use your Google Account. Email or phone. Forgot email? CAPTCHA image of text used to distinguish humans from robots. Type the text you hear or see. Family Link. arrow_drop_down Toggle Google Fi Wireless. Google Fi Add a recovery phone number and email address to your account. If you use 2. To get a Gmail account connected with a mobile number, follow these steps: Go to the Gmail account creation page at Create your Google Account. Add a phone number to your email signature · Select the newly added phone number (it should be highlighted in blue) · Click the Link icon in the signature editor. On any Google sign-in screen with an "Email or phone number" field, enter your phone number. · Select Next. · Finish signing in as you usually do. I was wondering if there is any way to at least view the gmail accounts under my phone number. When I try to send email as HTML the Gmail is automatically generating a blue link (hyperlink to google map). I have used below solution (css). Find your email. Enter your phone number or recovery email. Phone number or email. Next. Family Link. arrow_drop_down Toggle Google Fi Wireless. Google Fi Add a recovery phone number and email address to your account. If you use 2. Sign in. Use your Google Account. Email or phone. Forgot email? CAPTCHA image of text used to distinguish humans from robots. Type the text you hear or see. Family Link. arrow_drop_down Toggle Google Fi Wireless. Google Fi Add a recovery phone number and email address to your account. If you use 2. To get a Gmail account connected with a mobile number, follow these steps: Go to the Gmail account creation page at Create your Google Account.

If multiple Gmail accounts are created from the same IP or device within a short period, phone number verification becomes mandatory. While it might be. Email addresses and phone numbers associated with your Microsoft account are called aliases and they use the same contacts, online storage, subscriptions. Open your device's Settings app and tap Google and then Manage your Google Account. At the top, tap Personal info. In the "Contact info" section, tap Phone. I was wondering if there is any way to at least view the gmail accounts under my phone number. Find your email. Enter your phone number or recovery email. Phone number or email. Next. Sign in. Use your Google Account. Email or phone. Forgot email? CAPTCHA image of text used to distinguish humans from robots. Type the text you hear or see. Enter your new phone number on the next screen, then tap Send code and enter the verification code sent to your updated mobile device. Note: Since we send. Some email accounts use two factor authentication which means you must use the same phone number that you did when creating/signing up for the account, in order. Don't worry—if you change your account alias, or remove an alias and then add a new one, all licenses linked to your Microsoft account will remain with your. You can add or remove a mobile phone number from your account in your settings. We recommend that you always add an email to your account to help you gain. Unfortunately, it is not possible to find someone's Gmail account associated with their phone number. Google does not provide a way to search. A smarter phone number · Save time, stay connected · Take control of your calls. Click on the "Email to Text" icon at the bottom of the draft window. Here you can add phone numbers from existing Google Contacts or add new ones. 5. When all. You can visit your password manager and check out all the accounts linked to your email address(es) or phone number(s). Most browsers, like Mozilla Firefox. Gmail with your Google Calendar and Google Maps to make sure that you're always on top of your schedule. Built for you. No matter which device or Google. Unfortunately, it is not possible to search for Gmail accounts associated with a particular mobile number. Gmail does not provide a way to. These users probably used a tricky method: they initially registered a Gmail account with one phone number and, once created, linked the account. Next, you must verify your phone number. You can choose to receive a verification code via text message or voice call. When you receive the code, type it into. Dial a phone number 1––2-Google (1–––) or 1 () – shown on the screen or call a Google customer support phone number, open 24*7 hours. 1. Use a Different Phone Number: Ensure the phone number you're using hasn't been used for Gmail verification multiple times.

What Is A Put Option On A Stock

A put option is a financial tool to bet against a company. Instead of selling the underlying stock (which is called a short), one can buy a put. The value of a put option increases if the asset's market price depreciates. For stock options, each contract is worth the equivalent of shares. A put option is a contract that entitles the owner to sell a specific security, usually a stock, by a set date at a set price. If you buy a put, you're buying the right to sell a stock at a certain price. You're betting the price will go down. The put buyer is like a short seller. This. An option that allows the owner of the underlying stock to sell it at a set price within the stated time period is known as a put. Options: Calls and Puts · An option is a derivative, a contract that gives the buyer the right, but not the obligation, to buy or sell the underlying asset by a. A put option is a derivative contract that lets the owner sell shares of a particular underlying asset at a predetermined price (known as the strike price). Protective put (long stock + long put) · Potential Goals · A protective put position is created by buying (or owning) stock and buying put options on a share-. Put options are traded on various underlying assets such as stocks, currencies, and commodities. They protect against the decline in the price of such assets. A put option is a financial tool to bet against a company. Instead of selling the underlying stock (which is called a short), one can buy a put. The value of a put option increases if the asset's market price depreciates. For stock options, each contract is worth the equivalent of shares. A put option is a contract that entitles the owner to sell a specific security, usually a stock, by a set date at a set price. If you buy a put, you're buying the right to sell a stock at a certain price. You're betting the price will go down. The put buyer is like a short seller. This. An option that allows the owner of the underlying stock to sell it at a set price within the stated time period is known as a put. Options: Calls and Puts · An option is a derivative, a contract that gives the buyer the right, but not the obligation, to buy or sell the underlying asset by a. A put option is a derivative contract that lets the owner sell shares of a particular underlying asset at a predetermined price (known as the strike price). Protective put (long stock + long put) · Potential Goals · A protective put position is created by buying (or owning) stock and buying put options on a share-. Put options are traded on various underlying assets such as stocks, currencies, and commodities. They protect against the decline in the price of such assets.

A put option is a contractual agreement, giving its owner the ability to sell an underlying asset at a pre-agreed value, known as the 'strike price'. An option is a security, just like a stock or bond, and constitutes a binding contract with strictly defined terms and properties. For most casual investors. *If* the stock plummets and I have a put option for a high value, I can buy the stock for cheap on the market and then sell it at the strike. This strategy consists of buying puts as a means to profit if the stock price moves lower. It is a candidate for bearish investors who want to participate in. A put option is a contract tied to a stock. You pay a premium for the contract, giving you the right to sell the stock at the strike price. You're able to. A put is a type of options contract that gives the holder the right, but not the obligation, to sell a specific underlying asset (such as a stock, commodity, or. A put option is a type of financial contract in the options market that gives the holder the right, but not the obligation, to sell a specified amount of an. A put option is a contract that gives an investor the right, but not the obligation, to sell shares of an underlying security at a set price at a certain time. When you sell a put option, you promise to buy a stock at an agreed-upon price. It's better to sell put options only if you're comfortable owning the underlying. So you buy put options of company XS at the rate of Rs 50 each, giving you the right to sell them at that price on the expiry date. If the price of the XS share. Simply put (pun intended), a put option is a contract that gives the option buyer the right — but not the obligation — to sell a particular underlying security. Put options are most commonly used in the stock market to protect against a fall in the price of a stock below a specified price. In this way the buyer of the. A put option has a similar profit potential to a short future. When prices move downward the put owner can exercise the option to sell the futures contract at. If the option is exercised, the investor then sells the stock at that strike price. Investors can also create a short position, by exercising a put option when. A put option gives its buyer the right to sell its underlying stock at a predetermined strike price on the expiration date. However, a put buyer isn't obligated. Put options are a contract that gives the holder the right to sell a set amount of equity shares at a set price; it is called the strike price before the. An put option is a contract giving someone the right, but not the obligation, to sell a specified amount of an underlying security (i.e., shares in a. A put option gives the contract owner/holder (the buyer of the put option) Buying a call option requires less capital than buying the stock outright. An option contract gives the owner the right, but not the obligation, to buy or sell an underlying asset for a specific price within a specific time frame. An option contract can be a Call Option or Put Option. A call option comes with a right to buy the underlying asset at a pre-agreed price on a future date.

Trading Emini Futures

Summary · An e-mini is a standard futures contract that is broken down into a fractional portion of a stock index. · E-mini futures are traded electronically. E-Mini futures provide trading advantages that many other contracts do not offer. They are very liquid, which equates to tight spreads, and are much more. In nearly every trading scenario, ES futures offer a more cost-efficient way to manage S&P exposure compared to ETFs. Pay no management fee when you trade. The Emini S&P futures contract trades in (1/4) point increments. As each contract is equal to $50 x the S&P Index, a price move equates to. An e-mini trading strategy is a strategy that trades one of the e-mini contracts. An E-mini is an electronically traded futures contract that is a fraction of. Contract specifications ; /MYM, Micro E-mini Dow, 1, $, 6 p.m.– p.m. ; /RTY, E-mini Russell, , $, 6 p.m.– p.m. S&P index futures provide exposure to individual stocks in the index. But trading futures is different from trading equities. Understand how they work. wstanley.ru by Cannon Trading, was developed exclusively for online e-mini futures trading, so you can trade smaller sized online futures contracts. Trading micro-E mini futures is a great way to access the futures market without risking a large amount of capital. You can use your broker's backtesting model. Summary · An e-mini is a standard futures contract that is broken down into a fractional portion of a stock index. · E-mini futures are traded electronically. E-Mini futures provide trading advantages that many other contracts do not offer. They are very liquid, which equates to tight spreads, and are much more. In nearly every trading scenario, ES futures offer a more cost-efficient way to manage S&P exposure compared to ETFs. Pay no management fee when you trade. The Emini S&P futures contract trades in (1/4) point increments. As each contract is equal to $50 x the S&P Index, a price move equates to. An e-mini trading strategy is a strategy that trades one of the e-mini contracts. An E-mini is an electronically traded futures contract that is a fraction of. Contract specifications ; /MYM, Micro E-mini Dow, 1, $, 6 p.m.– p.m. ; /RTY, E-mini Russell, , $, 6 p.m.– p.m. S&P index futures provide exposure to individual stocks in the index. But trading futures is different from trading equities. Understand how they work. wstanley.ru by Cannon Trading, was developed exclusively for online e-mini futures trading, so you can trade smaller sized online futures contracts. Trading micro-E mini futures is a great way to access the futures market without risking a large amount of capital. You can use your broker's backtesting model.

An S&P E-Mini is a contract between buyers and sellers who agree to exchange money based on the performance of the S&P If a buyer goes long on the S&P. Results · E-MINI AND MICRO E-MINI TRADING: Three Models to Create Wealth for All Traders · E-MINI AND MICRO E-MINI TRADING: Three Models to Create Wealth for. E-mini futures trading - AbleTrend trading software provides clear market signals for E-Mini traders such as when to buy/sell/hold/exit for any market. EMiniPlayer provides accurate Support/Resistance Zones, along with a concise Trade Plan for trading the E-Mini S&P Futures every morning before the Open. E-mini contracts are traded and offered widely on the CME for a number of different assets, but the E-mini S&P contract is by far and away the most popular. E-mini is a futures contract that is traded electronically. Get to know its meaning, the process of trading, along with the benefits of investing in E-Mini. The current price of S&P E-mini Futures is 5, USD — it has risen % in the past 24 hours. Watch S&P E-mini Futures price in more detail on the. Each point move ("handle") in the E-Mini S&P futures contract equals $ A two "handle" move from to equals $ A one-half "handle". Basically, E-mini contracts let you trade on the future price of different assets without actually owning them. They're a bit like making a bet on where you. E-mini S&P index futures trading is an agreement between a buyer and seller at a specified price in a contract that will expire on a specific date. Traders. The E-mini S&P index futures contract is a tradable instrument representing of the largest stocks on the US stock exchanges. A one point move in the. The Emini (or E-mini, ES, or Mini) is a futures contract that tracks the S&P stock market index. It is traded on the Chicago Mercantile Exchange (CME) via. Advantages of trading emini futures · International exposure: Trading in e-mini S&P futures means that you will be able to get exposure to global companies. 1. Trend Trading. When it comes to trading strategies, trend-following is among the most popular. · 2. Trading Rotation. A rotational or compressed market lacks. Some things to keep in mind for Micro Futures Contract Trading, is that while a single E -mini S&P futures contract has a value of $50 per each point, the. An online trading resource for traders wanting to learn day trading stock index futures. You will see Index Futures Trading, Daily Market Analysis. S&P E-Mini Futures Market News and Commentary The S&P Index ($SPX) (SPY) today is up +%, the Dow Jones Industrials Index ($DOWI) (DIA) is up + For largely priced contracts, like the E-Mini S&P contract, The tick size is , that is it trades only in 25 cent increments. Tick cash value. E-minis are futures contracts that represent a fraction of the value of standard futures. They are traded primarily on the Chicago Mercantile Exchange.

Invest The Money

How much does it cost to invest in Vanguard money market funds? Each of our mutual funds has an expense ratio—a built-in cost for running the fund. The annual. There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more. There are several ways you can invest on your own, including Online Investing, Direct Investing, and Dividend Reinvestment Plans. What do you know about saving. To help you make better decisions, take time to understand both the opportunities and risks of any investment you're considering. Some investment plans like ICICI Pru Signature provide you with an option to invest in high-risk equity funds, low-risk debt funds or balanced funds, basis. President Biden's Investing in America agenda is mobilizing historic levels of private sector investments in the United States, bringing manufacturing back to. Track your savings and investments, and monitor what you own; Plan for short-term and long-term goals; Build up emergency savings for unexpected events. The first step to successful investing is figuring out your goals and risk tolerance – either on your own or with the help of a financial professional. A step-by-step guide to choosing and managing your own investments. Pick an account. Choose and open the account(s) that are right for you. How much does it cost to invest in Vanguard money market funds? Each of our mutual funds has an expense ratio—a built-in cost for running the fund. The annual. There are several ways you can start investing, including stocks, ETFs, mutual funds, bonds, CDs, real estate, and more. There are several ways you can invest on your own, including Online Investing, Direct Investing, and Dividend Reinvestment Plans. What do you know about saving. To help you make better decisions, take time to understand both the opportunities and risks of any investment you're considering. Some investment plans like ICICI Pru Signature provide you with an option to invest in high-risk equity funds, low-risk debt funds or balanced funds, basis. President Biden's Investing in America agenda is mobilizing historic levels of private sector investments in the United States, bringing manufacturing back to. Track your savings and investments, and monitor what you own; Plan for short-term and long-term goals; Build up emergency savings for unexpected events. The first step to successful investing is figuring out your goals and risk tolerance – either on your own or with the help of a financial professional. A step-by-step guide to choosing and managing your own investments. Pick an account. Choose and open the account(s) that are right for you.

Investments are something you buy or put your money into to get a profitable return. Most people choose from four main types of investment. Diversification mixes a variety of investments, such as stocks, bonds, or real estate, within a portfolio to reduce portfolio risk. Savings is setting money aside for use at a later time. Investing is using a resource (usually money) with the expectation that it will generate increased. Mutual funds and ETFs let you buy different combinations of common investments like stocks, bonds, commodities and real estate. Investing in these funds means. Investing is to grow one's money over time. The core premise of investing is the expectation of a positive return in the form of income or price appreciation. The building blocks include stocks, bonds, cash equivalents and various kinds of funds. Understanding your choices can help you determine the right investments. Todd typically recommends an investment fund comprising of at least 75% stocks for goals in this time frame. Having a portfolio with 25% in bonds helps to. Schwab Value Advantage Money Fund® – Investor Shares (SWVXX) · 7-day yield (with waivers) as of AM EDT 09/13/ % · Minimum Initial Investment. $0*. Access % average yields on money market funds with J.P. Morgan Self-Directed Investing. When you open a J.P. Morgan Self-Directed account, you'll get access. It's important that you go into any investment in stocks, bonds or mutual funds with a full understanding that you could lose some or all of your money in any. Wells Fargo can help with your investing, retirement and wealth management needs with financial advisors, automated investing and self-directed investing. Learning to save money and invest early on, will enable students to carry on good habits that will lead to accumulating wealth at an earlier age. Plan, research, and diversify — these are the keys to successful investing. They'll help you find investments that fit your risk tolerance and investment time. Get your immediate finances in order before you invest. Pay off any short-term debt, have an emergency cash fund and consider investing more in your. Consider the Vanguard Cash Plus Account, money market funds, or brokered certificates of deposit (CDs) to save for your short-term goals. The Federal Investments Program represents almost a quarter of the public debt outstanding, providing services to approximately trust, deposit, and special. Most mutual funds set a relatively low dollar amount for initial investment and subsequent purchases. Liquidity. Mutual fund investors can easily redeem their. Start Investing With eToro · 1. Shares. Buying shares in a company may reward investors with capital growth and an income in the form of dividends. · 2. This guide can help with step 1: The basics of investing? An investment in its simplest form is when you buy something with the hope of it increasing in value. 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Open a certificate of deposit (CD) · 5. Invest in money market funds · 6. Buy.